Lauren Killgore first learned about her health insurance company’s new policy at the beginning of 2017, when her husband, a 26-year-old hemophiliac, had an internal bleed in his knee.

Her husband had always used a $12,000 copay card from the drug manufacturer to pay for his medication.

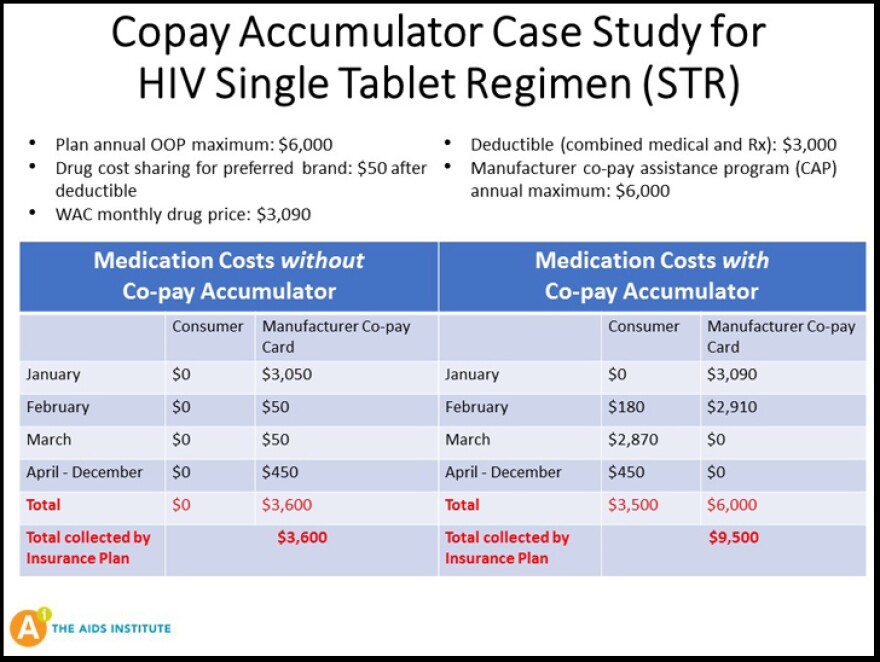

The insurance company would apply the payment to their $6,500 deductible, helping them meet their out-of-pocket obligation for the year.

But this time, the pharmacy said the payment could not be used toward their deductible.

They would have to pay their entire deductible before the pharmacy would fill the medication again.

“We didn’t know what to do and we we’re both scared,” Killgore said. “We knew this was the worst bleed he ever had. And not having the proper medication, we didn’t know what life was going to look like after that.”

Killgore eventually learned her insurance plan now included something called a copay accumulator. It’s a confusing name for a practice that keeps assistance from the drug manufacturers from counting toward a patient’s deductible.

Over the past three years, health insurers around the country quietly have been adding these policies to their plans. In Florida, The AIDS Institute has found at least five companies using this practice.

For Killgore’s husband, the policy turned out to be catastrophic. He went about a month without medication that would stop the bleed in his knee and eventually landed in the hospital.

He now has permanent knee damage and a joint that is more susceptible to bleeding.

“It’s really depressing, especially since the policy has affected my husband’s life forever,” Killgore said. “It’s everything that follow’s someone with a chronic disease that has a debilitating mobility issue. It’s depression and anxiety and the feeling of helplessness. It’s affected everyone in our household.”

Kollet Koulianos is with the National Hemophilia Foundation and she was among the first to discover the practice back in 2016.

Copay accumulators can impact anyone, but those who are most at risk are patients with high deductible plans who rely on high-price prescription drugs. They often have no indication that a copay accumulator has been added to their plan until they try to have their medications filled at the beginning of the year. Because their monthly prescriptions can cost tens of thousands of dollars, they are forced to pay their entire deductible all at once if they want to have their medications.

Groups representing people with AIDS, arthritis, multiple sclerosis and hemophilia, among others, have been bombarded with calls from patients who are having to go without their medications because they can't afford them.

“This is holding the drug hostage,” Koulianos said. “This is life and death and it's simply not acceptable.”

The average cost for hemophilia drugs is $250,000 a year. Koulianos says she's seen it run as high as $1 million a month.

For insurance companies, the policies are a way to get patients to pick up some of the costs or to look for cheaper drugs or alternative treatments.

The theory may work for patients who can get treated with less expensive or generic medications.

But for hemophilia patients there are no alternatives, Koulianos said.

"This isn't going to work out the way they intend it," she said.

For hemophilia patients, this policy can backfire on insurance companies, Koulianos said. Patients who don't get their medications could end up in the hospital or worse. That costs insurance companies much more.

This year, the policy has caught the attention of lawmakers.

Three states passed laws prohibiting copay accumulators, but Florida wasn't one of them. And In April, the U.S. Department of Health and Human Services came up with rules that could stop the practice next year -- but only when there's no generic drug available.

The changes made by HHS should solve the problem for hemophilia patients because there is no generic available for their medications.

But for patients who have alternatives, it can be more complicated.

Some generics can cost nearly as much as brand name drugs, Koulianos said.

"They can't afford the deductible, that's the problem,” she said. “The cost of the drug is always going to be way higher than the deductible."

Koulianos also isn't convinced that the federal rule will solve the issue.

It's only a matter of time, she said, until insurance companies come up with a new way to get around the regulations.