Last month, Sarasota County commissioners directed Administrator Jonathan Lewis to work with constitutional officers to find the cuts needed to halt a looming shortfall projected to sink county finances into the red within three years.

But since then, the Tax Collector’s budget instead went up, the Sarasota Sheriff has held firm on a $25 million increase, and commissioners are now blasting what they contend has been a lackluster effort to trim excess spending without raising taxes.

Lewis sent emails to those elected officers on July 8 citing a modest 4% increase in county revenues – and reinforcing how the current spending path would outpace those collections and dig the county deeper in the hole.

Despite the request, county leaders shaved just $2.2 million collectively from their budgets – leaving more than $20 million that still needs to be cleared from the books to match revenue projections.

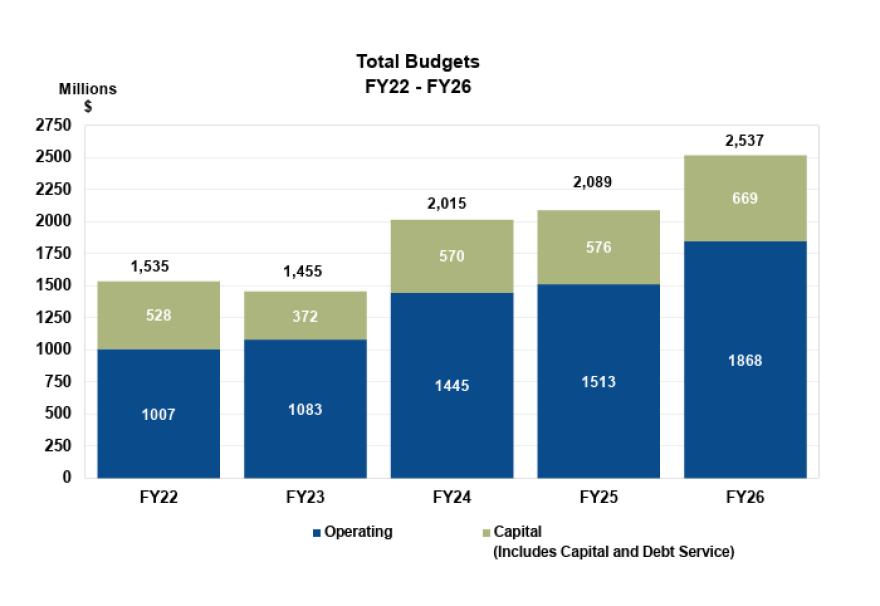

Sarasota County’s proposed $2.5 billion budget is the most the county has ever spent in a single year – up about $500 million from last year’s approved budget alone.

With little progress over the past month – and time running out to approve funding for fiscal year 2026 – commissioners are scheduled to meet again Tuesday for a fifth budget workshop to vet options. But several of the elected officials under fire for their spending won’t even be there.

If no additional savings can be identified, the county budget will remain the same as it was after the contentious July workshop – representing a more than 20% increase from the prior year.

“It’s millions and millions of dollars that we are going to have to pull out of reserves in just two years,” County Commissioner Tom Knight told Suncoast Searchlight. “We’re on a path to destruction.”

Former Commissioner Joe Barbetta also called the spending “outrageous,” and he urged commissioners to push back.

When Barbetta left office in 2014, the county’s budget had just surpassed $1.1 billion – funding about 2,100 employees. The current proposed budget has more than doubled in about 10 years and now funds nearly 4,200 positions.

“No matter what the constitutional officers sit there and tell you, the buck stops with you guys,” Barbetta said of the County Commission, “the five of you.”

New guns and more deputies: No relief from swelling Sheriff budget

The largest overage in spending to the county’s general fund this year comes from the Sarasota County Sheriff’s Office.

Sarasota Sheriff Kurt Hoffman requested a 12.7% increase in what would be a $223 million budget. In a letter responding to Lewis, Hoffman pointed to unexpected costs associated with court security. He also cited an urgent need to replace the handguns carried by his deputies after the July death of a U.S. military airman was connected to a faulty firearm discharging without anyone pulling the trigger.

“I have made the decision that in the best interest of the public, and our workforce, that we will transition away from the Sig Sauer P320 firearm,” Hoffman wrote.

The increase in court security costs stems from a request from Chief Judge Diana Moreland, who notified the Sheriff on July 24 that his office was required to staff a drug court on Mound Street. Hoffman said that will add three more deputies to his budget, even as he was already requesting to add 28 deputies next year.

The Sheriff projects to save through reducing medical expenses at the jail by signing up inmates using the Affordable Care Act. In total, he cut $2.4 million – or slightly more than 1% of his overall budget.

Knight, who served 12 years as the Sarasota Sheriff before joining the County Commission, says he’s unimpressed with the effort to trim costs.

Knight’s first Sheriff’s budget in 2009 coincided with the onset of the Great Recession. He remembers the painful decisions made by the County Commission at the time as the agency cut $1.4 million. There were layoffs. Retirements meant positions went unfiled. Maintenance was deferred and services reduced.

He’s now urging Hoffman and the other constitutional officers to take similar steps, even if they seem daunting, to protect taxpayers feeling the pinch.

Hoffman will not be in Florida on Tuesday, and the Sheriff's Office did not respond to a Suncoast Searchlight request seeking to clarify whether anyone from department leadership will attend the budget workshop.

“To me, people not showing up to have a conversation about a $2.5 billion budget is being confrontational, not collaborative,” Knight said.

Proposed Sarasota Tax Collector budget goes further up – not down

Sarasota Tax Collector Mike Moran told Lewis that not only were there no identified cuts this summer, but that his budget would actually increase from earlier projections on July 1.

He will not be there on Tuesday, either.

The Tax Collector budget is approved by the state Department of Revenue, so the County Commission has no authority to change it.

The first budget proposed under Moran – a Republican – is set to increase by more than one-third compared to the final budget approved by prior Tax Collector Barabara Ford-Coates, a Democrat who was defeated by Moran in November after decades in office.

The massive jump in expenses, Moran said, was due to urgent need for technology upgrades and concerns about security on the outdated systems.

Under a state requirement, the department for decades has kept a small share of the total taxes it collects to cover expenses for postage and other aspects of accessing countywide taxes. Because it’s usually more than the department needs, the office has then returned back $15 to $20 million each year to the county’s general fund.

As part of his first budget, Moran wrote in letter to Lewis that he’s seeking a legal opinion about his ability to stop collecting “excess commissions” and hopes the County Commission will support “legislative changes to change this process.”

Commission Chairman Joe Neunder said he was “shocked” by Moran’s push to change the longstanding formula at the Tax Collector’s office.

“Something like this, this late in the game,” Neunder said, “I think it really hurts us.”

As county needs grow, future property taxes could shrink

After the paltry $2.2 million in identified savings, the county continues to project shortfalls of $25.2 million in fiscal year 2028, $37.8 million in fiscal year 2029 and $36 million by 2030.

If state lawmakers get their way, those projected shortfalls could get even more dire.

Neunder, who is also a committeeman for the Republican Party of Sarasota County, said at a recent local meeting that state-level GOP officials made clear there will be a ballot amendment in 2026 focused on reducing property taxes.

“At the minimum, we’re talking about doubling the homestead exemption,” Neunder said.

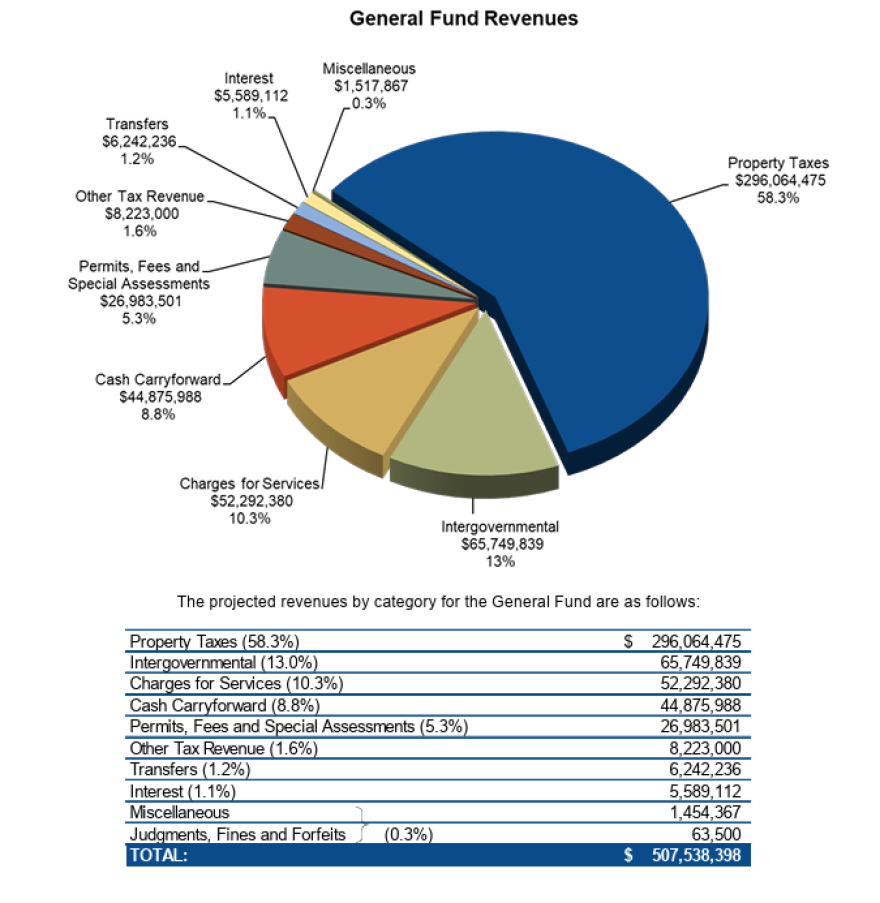

This year, Sarasota County will take in $296 million in property taxes, which accounts for nearly 60% of the general fund’s revenue.

A reduction in property tax revenue could force counties throughout the state to reduce services or raise local taxes to make up the difference.

That hole could be worse for areas like Sarasota and Manatee counties, now dealing with infrastructure challenges after years of recent population growth.

“I’m of the mindset that we have to do something now,” Neunder said.

This story was produced by Suncoast Searchlight, a nonprofit newsroom of the Community News Collaborative serving Sarasota, Manatee, and DeSoto counties. Learn more at suncoastsearchlight.org.