Florida's chief financial officer was in St. Petersburg on Wednesday to support a proposed constitutional amendment that would limit local property taxes.

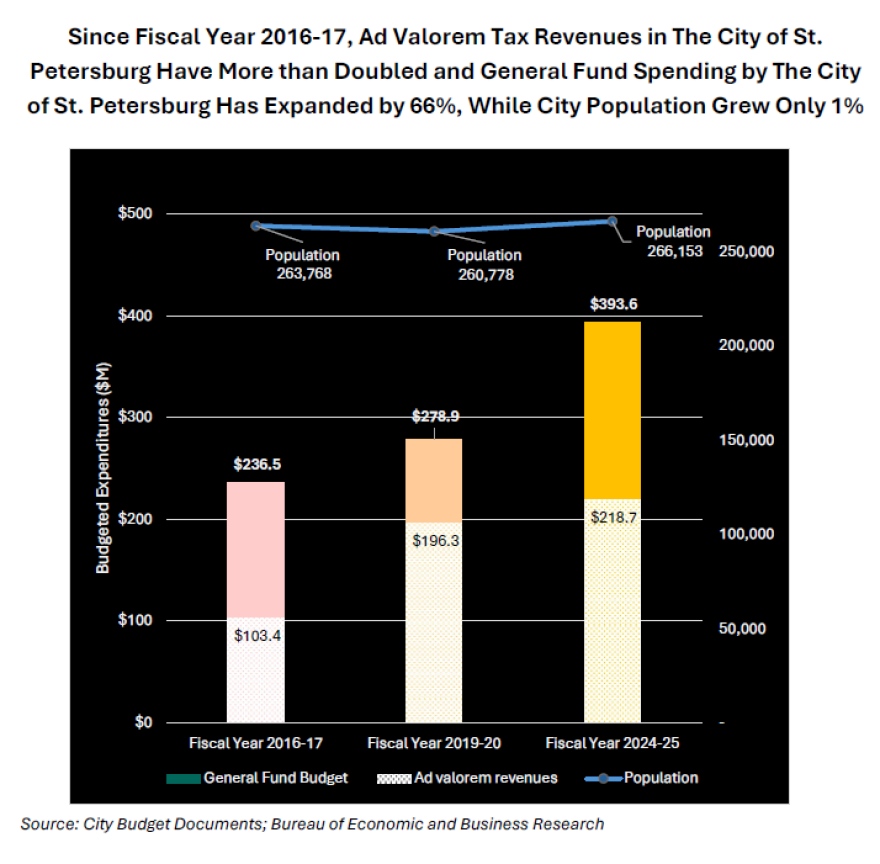

Blaise Ingoglia said St. Petersburg has overtaxed its residents by $49 million over the past six years.

A report from his office says the city spent more than $300,000 for sustainability initiatives, like carbon reduction and electric vehicle promotion. He also pointed to more than $1 million in salary increases in the mayor's office since 2019.

"It's concerning because government just thinks that you're an ATM. Zero fiscal constraint whatsoever, taking all the extra money that is available to them, never even thinking once of giving it back to the taxpayers," he said during a news conference.

"Government at all levels has a spending problem. They don't have a revenue problem. It's clear that they don't have a revenue problem. There is no restraint on local government whatsoever."

Ingoglia launched the Florida Agency for Fiscal Oversight (FAFO) in 2025 to audit local government spending for waste and inefficiency.

It's all part of a push by the DeSantis administration in support of a proposed statewide constitutional amendment to limit how much local governments can get from property taxes.

"Property tax relief is absolutely 100% attainable here in the state of Florida. There is more than enough money to fund fire, to fund police, to fund EMS, to fund essential services," Ingoglia said. "There is more than enough to account for inflation. There is more than enough money to account for the population. But when you exceed all of that and see this pot of money and show zero fiscal restraint whatsoever, the taxpayers are on the foot of that, and the taxpayers are starting to get frustrated."

St. Petersburg Mayor Ken Welch called his claims unsubstantiated.

"The CFO's claims are unsubstantiated and targeted to support the obvious political agenda of justifying property tax changes, regardless of the impacts on police and fire service delivery by local governments." - St. Petersburg Mayor Ken Welch

"Today, Florida's CFO asserted statements about the City of St. Petersburg’s budget and said that any response or rebuttal from local government would just be a “spin.” He made it clear that any clarification or correction would be local governments “justifying excessive and wasteful spending," he said in a statement.

"The CFO's claims are unsubstantiated and targeted to support the obvious political agenda of justifying property tax changes, regardless of the impacts on police and fire service delivery by local governments. We will continue to operate based on facts, not conjecture."

Here are some details from the CFO's report:

St. Petersburg Excessive Spending Examples:

- City funds spent to implement carbon reduction and electric vehicle promotion experts, following $307,000 spent on a sustainability action plan.

- Tens of thousands of dollars spent on small-dollar grants to organizations, many with extreme ideological missions to promote DEI objectives or other inappropriate missions. Beyond the substance of the spending, large numbers of small-dollar grants create particular oversight challenges for the city, and the burdens of meeting compliance requirements often impose costs on recipients that are disproportionate to the benefits provided by the grant.

- $1.1 million in salary increases in the Mayor’s Office since Fiscal Year 2019-20 – with two members of the staff receiving 60%+ in raises

- 355 new city workers – 10%+ growth – between Fiscal Year 2019-20 and Fiscal Year 2024-25 budgets.