Facing rising costs of premiums, about 202,000 fewer Floridians purchased insurance from the Affordable Care Act marketplace during the 2026 enrollment period.

It was one of the starkest declines, just behind Georgia, which had a decline of 206,000, according to new data released by the Centers for Medicare and Medicaid Services.

Florida still has more enrollees in the federal marketplace than any other state.

"While we do recognize that costs have increased, there still is a demand for coverage and a demand for work," said Xonjenese Jacobs, director of the Covering Florida Navigator Program, which assists ACA customers in choosing a plan.

ALSO READ: Higher ACA premiums squeeze Florida's 'working stiff' as enrollment numbers plunge

She said navigators experienced a lot of customer frustration over the increase in premium prices.

"Oftentimes, they'll call and they'll say, 'Well, I thought this was supposed to be affordable,' " she said. "There was a lot of frustration, a lot of folks that say, 'I think I did something wrong (seeing the high cost).' "

According to estimates by KFF, a nonpartisan health policy research organization, premiums were expected to rise an average of 114% nationwide after the federal government allowed a temporary, pandemic-era tax credit to expire Dec. 31.

The enhanced subsidy, created during COVID, lowered monthly premiums by increasing the size of tax credits and removing income caps for eligibility. Without it, many enrollees faced significantly higher costs.

In Florida, about 97% of marketplace customers used the credit, KFF research shows.

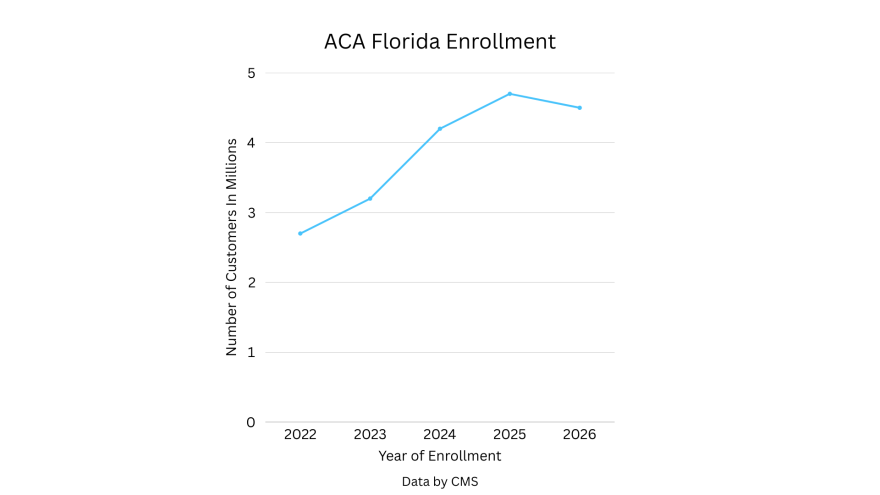

The subsidy was expanded in 2021 under the American Rescue Plan, allowing even households earning more than 400% of the federal poverty level to qualify. Afterward, enrollment increased sharply in Florida from 2.7 million customers in 2022 to 4.7 million in 2025.

During this year's coverage period, enrollment fell to 4.5 million.

"Consumers were increasingly concerned about higher premiums following the expiration of enhanced premium tax credits, with many indicating that affordability was a primary factor in their enrollment or reenrollment decisions," Jacobs said.

Jacobs said the types of plans consumers typically bought also shifted. Consumers focused more on cheaper monthly premiums in exchange for a higher out-of-pocket deductible.

In some instances, consumers decided to forgo "silver plans," where they might have had an additional savings, but it cost more each month. For example, in some cases the premium jumped from $0 to $20 a month, Jacobs said. Many instead decided to go with a plan that was $0 in a "gold plan" category but has a higher max out of pocket.

ALSO READ: As ACA enrollment deadline arrives, health expert adds context to subsidy conundrum

"When we're looking at the numbers, it just tells me that Floridians want access to affordable, quality health care, and they're willing to ensure that this is one of those priorities for themselves and their family," she said.

This month, the House voted to extend the tax credit three years. The Senate is discussing its own version of an extension, but no movement has been.

While open enrollment is closed, special enrollment remains open for people who experienced a significant life change.

The Covering Florida Navigator Program is also still open, with navigators ready to answer questions on the best plans to fit an individual or family. Those interested in speaking with a navigator can visit coveringflorida.org or call 877-813-9115.

Copyright 2026 Central Florida Public Media