If you receive benefits from the Social Security Administration, your check will be a little fatter starting next month.

The federal government issued a 2.8% cost-of-living adjustment, or COLA, for benefits starting in January.

This calculation is done annually to ensure benefit amounts keep pace with inflation.

“The idea behind COLA is that we want people to purchase the same amount of goods over time. If prices go up, people need more money to afford the same amount,” University of South Florida economics instructor Michael Snipes said.

Tampa inflation outpaces COLA

In Tampa, prices grew by 3.3% over the past 12 months, outpacing the national average, according to the Consumer Price Index.

Snipes said that means, despite COLA, the purchasing power of Tampa beneficiaries will take a hit.

“This would affect people on fixed incomes most, as their budget and income constraints are the most rigid,” he said.

That’s the case for Aurea Aponte, 69, who lives gets about $1,000 a month from Social Security, and about 100 from the Supplemental Nutrition Assistance Program (SNAP).

She said this year’s adjustment to her benefits won’t make a dent in her expenses, especially at the grocery store.

“Everything is so, so ridiculous high. ... You're gonna buy a pack of eggs, and it's ridiculous," she said. "The price ... you're going to buy something that you need, really need for cooking or for living, and ...the prices are awful."

Affordability crisis for seniors

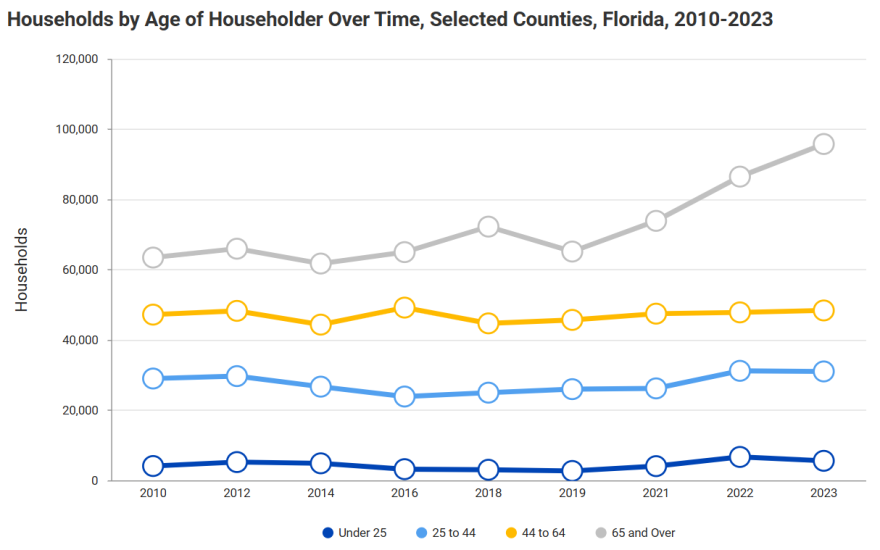

Across the greater Tampa Bay region, people 65 and older represent the largest group struggling to afford basic needs, according to research from United Way.

“So, not only are older adults struggling more and more these days, but the number of them struggling is growing considerably more than the other populations,” said Doug Griesenauer, vice president of community impact for United Way Suncoast.

For people on fixed incomes, it can be especially burdensome to afford rising housing, food and medical costs.

Aponte said she's had to rely more on food pantries, frequent thrift stores and occasionally ask her kids for help.

And during the holidays, she said her budget is much tighter.

“If we get out of budget, if we buy a toy for our grandkid … because it’s Christmas, that takes us off the budget,” she said.

The 'benefits cliff'

There’s another phenomenon that makes it hard to preserve the purchasing power of people on fixed incomes who receive government assistance.

“When individuals are on multiple programs, there is a subtler effect of what we call the ‘benefits cliff’ that comes into effect,” Griesenauer said. “[When] people start making more money, the benefits that they get in other areas decrease.”

For Aponte, her $30 a month adjustment to her Social Security income could mean she qualifies for less food and rent assistance in 2026.

“So, you do receive it, and it’s good, and we get happy, but then you receive the letter …that your food stamp has been lower … and then the Section 8 [federal housing assistance] that we get also get higher — because now we have more income,” Aponte said.

Griesenauer said this also affects retirees on fixed incomes who return to work only to find the added earnings don’t improve their financial situation.

“Without a full knowledge of the intricacies of how one lever impacts the other, something that might be seen as a positive choice might end up backfiring in the end because of how these things are connected,” he said.

Gabriella Paul covers the stories of people living paycheck to paycheck in the greater Tampa Bay region for WUSF. Here’s how you can share your story with her.